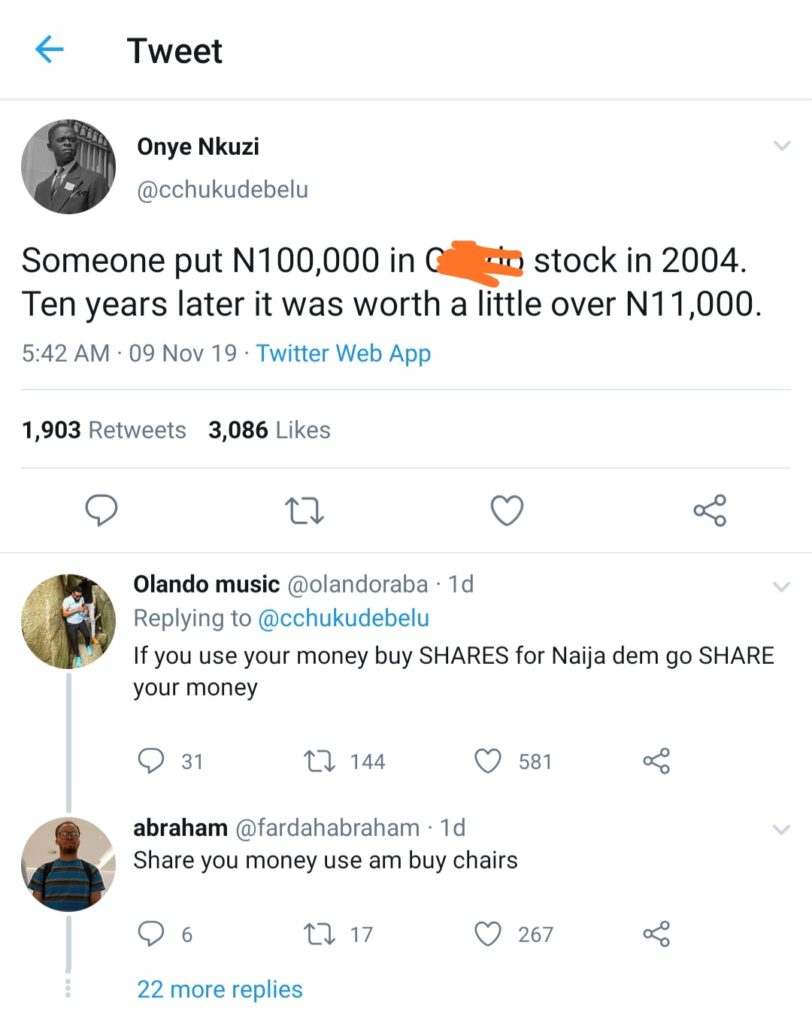

A twitter user @onyenkuzi posted saying: “Someone put N100,000 in ***** stock in 2004. Ten years later it was worth a little over N11,000.”

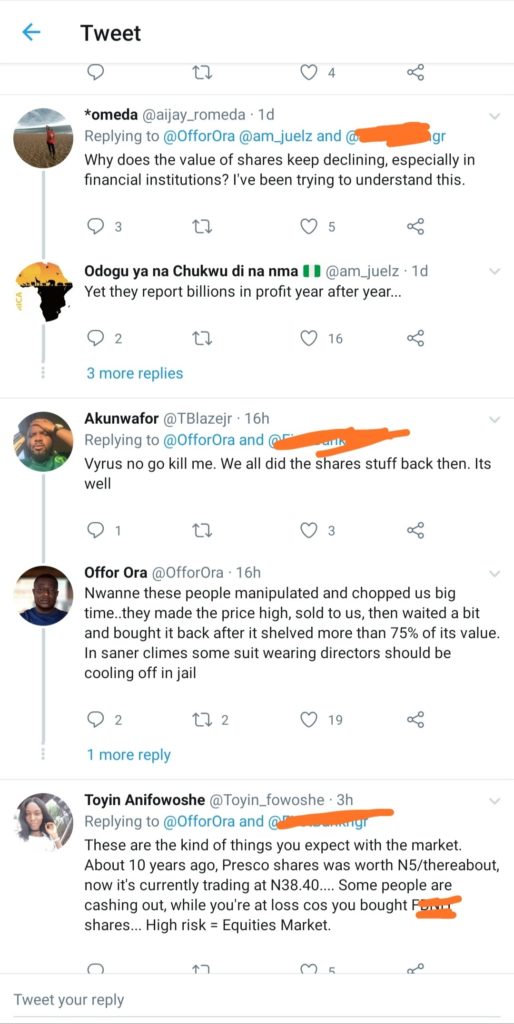

His tweet prompted an online frenzy with many Nigerians narrating tales of little or no returns on investment (ROI) from various traditional financial assets such as stocks and company shares. The thread followed with a list of more cases and some individuals ruing their chances of haven invested in other viable assets.

In a surprising twist of events, Bitcoin and cryptocurrencies were mentioned as better investment options by a few commentators; with reference to the Buy and Hold strategy.

@OfforOra tweeted: “I bought @*** share at around N33 about 12 years ago, its value is less than N6…I wish I bought palm oil with that money.”

In response: @Sknirt2c replied: “I’m just here imagining you bought bitcoin.”

Traditional Investment Instruments VS Cryptocurrency

Taking a balanced look at the average returns of company shares or stocks in Nigeria and globally, cryptocurrencies notably Bitcoin (BTC) has provided huge returns on investment for holders and much more for early investors.

The number one cryptocurrency has averaged a 6,592.83% ROI since its creation in 2009. Similarly, altcoins such as Ethereum (ETH) have returned 6,614.79% to date from the time of its launch in 2013 – about six years ago.

What’s more? While there are returns for holding long term, there are regular short term profits from Day Trading cryptocurrency and Bull Runs. However, these opportunities are not available with traditional financial assets.

The cryptocurrency ROI numbers across digital assets speak for themselves and are unrivaled by any traditional financial assets at this time.

Likewise, investment in natural minerals such as Gold and Oil have even in profit been surpassed by Bitcoin (BTC); which maintains its rank as the best performing asset.

A Beginner’s Guide to Asset or Cryptocurrency Investing

For every financial investment either shares, stocks, commodities or cryptocurrency; it is advised that you take the following basic steps.

-

- Invest in an industry or asset you know.

- Do Your Own Research.

- Seek the services of a professional financial adviser or for cryptocurrency have a friend / bitcoiner explain the basics of the market and how it works.

- If you’re looking to invest, note that while there are short term gains, there are long term returns. So be careful with the quick money mindset and schemes.

- Note that every investment involves risk, so invest only what you can ride to ZERO.

Hope this helps you get started with smart investing. Share and comment below.

NOTE: This publication is not an exhaustive insight into cryptocurrency or stock investing. Also, it does not serve as financial advice…Always Do Your Own Research.

Opinions expressed here are solely of the author and not a general view of the Bitcoin.ng team.